CHICAGO — The United States, and the world, have faced many challenges over the past few years, which have led to some unprecedented economic difficulties.

Fortunately, there has been some recovery from the pandemic-induced financial challenges.

However, there are still challenges to be faced.

In its forecast The Budget and Economic Outlook: 2023 to 2033 (February 2023), the Congressional Budget Office says:

- Economic output (gross domestic product, or GDP) is projected to stop growing early this year in response to last year’s sharp rise in interest rates. Output is projected to start growing again during the second half of 2023 as falling inflation allows the Federal Reserve to reduce interest rates, causing rebounds in sectors of the economy that are sensitive to interest rates.

- Inflation was higher in 2021 and 2022 than in any other years of the previous four decades: 5.7% and 5.5%, respectively, as measured by the price index for personal consumption expenditures. The annual growth of that price index is projected to remain above the Federal Reserve’s long-term goal of 2% through 2024 and then fall near to that goal by 2026.

- Interest rates on Treasury securities are projected to rise further in early 2023 and then gradually fall beginning in late 2023.

- The unemployment rate is projected to increase from 3.6% at the end of last year to 5.1% at the end of 2023 before gradually declining to 4.5% by the end of 2027.

These challenging factors mean that laundry and linen services need to be strategic and cautious when it comes to making capital investments in the near future.

RECENT FINANCING HISTORY

Supply-chain constraints, increasing rates and economic uncertainty have been top of mind for laundry operations the past few years, and these factors have affected laundry equipment financing/funding.

“Laundry project management has been crucial over the last few years,” says Jennifer Whitney, vice president of business development for Eastern Funding in New York. “Equipment manufacturers and distributors had increased lead times, construction resources were more limited and more expensive, and interest rates increased multiple times.

“Each of these factors alone would be challenging but possible to resolve quickly. With all of them happening at the same time, it created a perfect storm, which required all parties to ramp up communication, manage timelines and problem-solve if costs increased. It was truly a team effort to coordinate the completion of the project with the customer.”

Joe Lamping, inside sales representative for Milnor Capital in St. Louis, says the main way he saw financing affected over the past three years was by an increase in deferments and deal-making.

“It would be on a case-by-case basis for whatever the customer believed that they needed to be able to get through everything,” he shares.

Customers could ask for deferments from three to six months, and sometimes the company ran deferment promotions. Lamping says the main promotion was a three-month deferment.

“These would be like little three-month payments of $50 or $100 followed by 60 at whatever the normal payment would be,” he says.

Interest rates were also affected the past few years, running lower, Lamping says. But now rates are rising, and financing companies’ rates are rising as well.

“Nothing too drastic, but it’s definitely an adjustment,” he points out.

“We are seeing solid demand for financing so far in 2023, as industry consolidation offers growth opportunities for strong operators,” says Mark Thrasher, president of Lavatec Laundry Technology Inc. in Beacon Falls, Connecticut.

“The COVID-19 pandemic has resulted in a significant drop in the prime rate and inflation has caused a significant increase in the prime rate.”

“COVID was the contributing factor to the downturn in the hospitality market,” shares Tina Gough, senior finance sales specialist for Alliance Laundry Systems in Ripon, Wisconsin. “Since the hospitality market opened back up, it’s been a slow ramp up on occupancy to pre-pandemic levels. They are also having to manage through staffing shortages.

“This, in turn, has caused a decline in revenues and owners reluctant to retool and upgrade their laundry equipment. With regards to the healthcare sector, they have had a shortage of funding, preventing them from making capital investments.

“The bottom line is that in many facilities, across a range of industries, capital expenses have been reduced to the necessities.”

One thing that is holding over from the past few years for Milnor Capital is its promotions.

“We still offer a buck-a-pound promotion,” Lamping shares. “Essentially, the capacity of the washer or dryer is your payment for the first year.

“If you get a little 60-pound washer, then your payment for the first year would be $60 a month. After that, it would be the remaining payments at X.

“Or, like vacation resorts, they say, ‘I don’t get any business from December through February, what we can do?’ We structure their payments to where it fits best for them, essentially making it to where their December through February payments are like $50 or $100, and then the other nine months a year is a regular full payment to try and help the customer when it comes to cash-flow purposes.”

CAPITAL INVESTMENT TODAY

“While rates are certainly not as attractive as they were in 2022, there is still a good tax incentive in the form of bonus depreciation,” says Steve Hofmann, vice president of operations for U.S. Capital Corporation in Chicago.

“Bonus depreciation allows businesses to deduct a significant percentage of the price of purchased assets. In 2023, it allows for 80% upfront deductibility of depreciation.”

So, is it a good time for laundry operations to enter financing deals?

“I would definitely say it’s advantageous, especially with the world right now, we learned that you don’t really know what the future holds, so it’s best to hold onto your cash when you can,” Lamping says.

“Even just doing a short-term finance if you want to do a 24-month, obviously interest accrues over time, so if you just want to do a short-term option to try and not pay a lot of interest, it will at least spread your payment out over a certain amount of time.

“That way you don’t have to front all the cash up front and then potentially put yourself in a vulnerable position depending on the economy because we obviously know that it’s not the greatest right now. You don’t want to put yourself in a spot that could easily be avoided.”

“From a laundry lender’s perspective, I believe that there are more financing options available today for laundry operators than there were 10 and 20 years ago,” shares Whitney.

“The laundry industry has proven itself to be more resilient, during the most challenging times, and lenders have taken notice. Laundry operators need to find a healthy balance of financing and cash in order to maximize ROI ….

“They need to utilize financing to their advantage for equipment upgrades and reserve cash for intangible items, soft costs or operational emergencies that lenders may not be willing to finance.”

“Costs don’t seem to be going down, so now is as good as any time to invest in more efficient equipment and better technology to keep costs down and maintain overall efficiencies of the laundry room,” observes Gough.

“When savings from improved efficiency is figured in, often the payment can be made through those savings.”

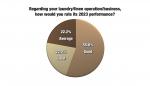

That begs the question of whether laundry and linen services are doing enough business to keep up with financing payments on capital investments in equipment.

“For the most part, yes,” said Hofmann.

“Even in our raising interest rate environment, we have not seen a significant impact in businesses not being able to make their loan payments,” Gough shares.

“During COVID, everybody was calling and saying we need to change, we need deferred payments,” shares Lamping. “We haven’t had that call in a while, so it’s definitely bouncing back.”

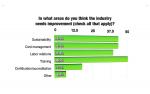

While laundry plants continue to purchase the same type of equipment, there have been minor shifts in focus over the past few years.

“The priorities are efficiency, maximizing throughput and ease of use,” Gough says. “Managers are increasingly looking beyond the upfront ‘price’ and are giving more weight to the overall operating costs—what the new equipment can produce in savings (due to advanced features and technologies) over their useful lives.

“So, whether it’s washer-extractors or tumblers, managers are looking for efficiency, capacities and equipment mixes to maximize throughput, and controls that are easy to use to simplify training.”

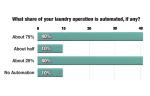

“We are seeing the same types of equipment being financed as usual, certainly with an emphasis on equipment that promotes facilities automation,” Thrasher shares. “In turn, this makes operators less dependent on variable labor.”

“Yes, a lot of customers because the job market right now not a lot of people are looking for jobs, I would say they’re definitely looking at ways to automate,” agrees Lamping. “We actually had one, I think it was last year, where they ended up instead of just having their employees dump their carts of laundry, they wanted a rail system.

“They were more future thinking because they’re having issues with finding employees. They’re like, we need the rail system to make it easier on our employees and where it’s more automated.”

He goes on to say that often the types of equipment laundries are purchasing come down to lead time.

“The lead times are definitely better than they were during late 2020, early ’21, but a lot of times, customers are kind of turning to where they are making their decision on whether they want to get new, used or whatever just based all on lead time at this point,” Lamping points out.

“Because a lot of customers, I feel, are assuming that lead times are back to 100%, we’re good. All these manufacturers have their stuff in stock, right? But that’s not quite the case yet.

“It’s trending in that direction, but it’s not quite there yet. Instead of a 12-week lead time, it’s like a four- to eight-week lead time.”

Check back Tuesday for advice for moving forward with future equipment purchases.

Have a question or comment? E-mail our editor Matt Poe at [email protected].