CHICAGO — After the past few years, it's challenging to maintain a positive attitude.

However, the laundry and linen services industry has a more positive attitude, overall, about business going into 2023.

That’s what the most recent American Laundry News Your Views survey indicates.

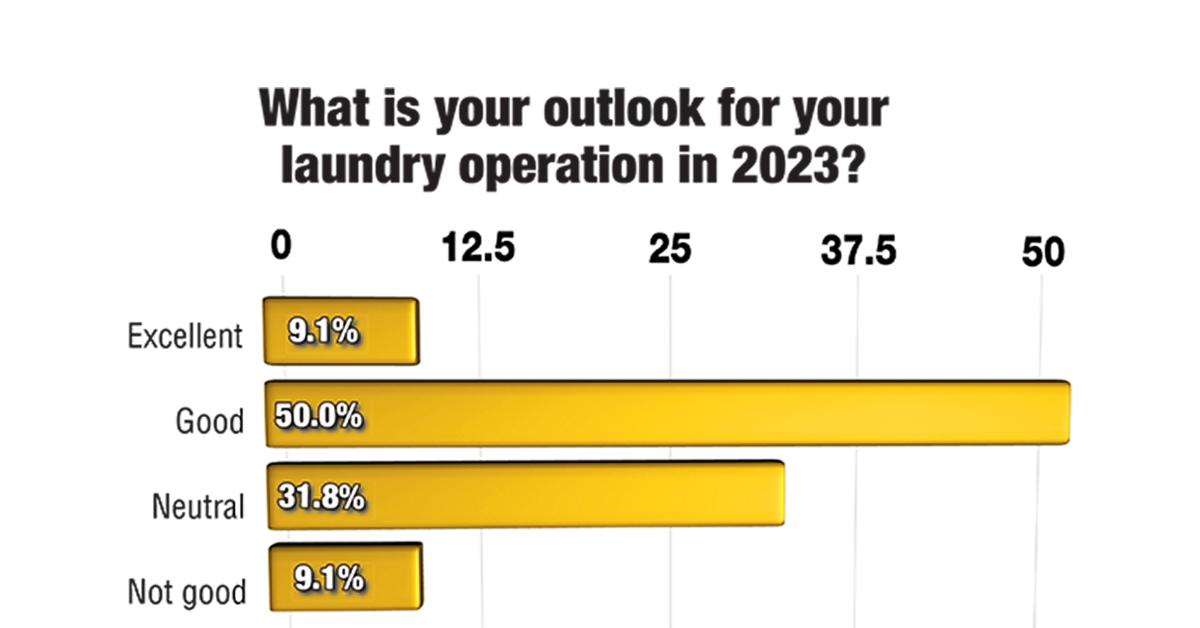

When asked, “What is your outlook for your laundry operation in 2023,” 50% of respondents indicate “good.” Just over 9% give an excellent outlook, while 31.8% are neutral.

Only 9.1% of survey takers don’t have a good outlook for 2023.

Some of the reasons given for these outlooks include:

- Improving productivity and customer retention has been a focus for the last 12 months, starting to pay dividends.

- After a (local) high point from COVID, and post-COVID vacations, the new normal is more challenging than times past.

- Volume has been increasing from the hospital organizations that we service.

- Rising input costs, including energy and textiles, plus the lack of available labor and the need to increase payroll costs to keep and retain employees paves a path to compressed margins and resulting financial hardship. Our client hospitals continue to resist non-contract price indexing to help mitigate or even share in the cost increases.

- Adaptation to inflationary influences and forecasting of expenses now with appropriate implementation of cost controls.

- Increased hospital census/expansions to licensed patient rooms and expanding clinical sites will drive demand for linen and challenge both my COG (customer-owned goods) vendor and laundry services.

- I’m more nervous for restaurants making it.

- Lots of demand for commercial.

- We will continue to work with our provider/processor for operational efficiency and product distribution. The biggest challenge has been trying to bring in any custom items that are somewhat reasonable in cost and that don’t have very long lead times.

When asked about their laundry’s No. 1 priority for the coming year, 26.1% of respondents say both “retain/improve staff” and “maintain present level of business.” More than 21% want to increase productivity, and 17.4% are looking to attract more business.

Almost 9% want to try to accomplish all those goals.

Overall, respondents believe their operations have a “good chance” (52.2%) of achieving the No. 1 goal. More than 30% say their laundry “will accomplish it, without a doubt,” and 13% give a 50-50 chance.

Only 4.3% indicate their operations have a “slim chance” to achieve their No. 1 goal.

When asked about the overall industry outlook for 2023, respondents offered mixed thoughts, including:

- It will depend on what part of the industry you are involved in. Healthcare should stay steady; hospitality may see a drop due to inflationary pressure on the consumer.

- This “impossible to outsource or fail” industry will have challenges that will make it stronger and more responsive.

- I am concerned broadly for our industry. Start with inflation and rising input costs, add on labor shortages and outsized increases to payroll costs, and many laundries will face financial hardship. The challenging labor dynamics for our industry are resulting in a loss of institutional knowledge and skills. As laundry operators cut corners to save money and live within their means, many will have to defer maintenance and capital reinvestments as they cope with a turnstile of low or untrained new employees.

- Hospitals are not going away for the most part and patients are becoming sicker and which will require longer LOS (length of stay).

- Turnover is killing efficiency with a lack of well-trained individuals. Without stability, it’s difficult to improve

- Guarded.

- Positive $$$

- I’m very excited!

- It will be a flat to slightly down year.

- Will retain average work out.

- Building commercial aspect, which adds profit.

Inflation/rising costs are top-of-mind for many respondents (47.8%) when it comes to the issues that they think will affect the industry in 2023.

Labor issues come in second, as 30.4% of survey takers indicate. Customer confidence and supply-chain issues were both selected by 4.3% of respondents.

“The industry is still responding too slowly to changes like inflation and changing labor practices,” a survey taker writes. “It’s still an unattractive, manual job that pays too little.”

“I think it’s actually a combination of at least a few of the items above,” shares another. “We continue to see supply-chain issues as well as a marked increase in rising costs.

“Labor continues to affect all of us in trying to find staff that wants to work and will stay.”

One respondent believes, “There will be ups and down due to various factors, none of them dominating predominantly.”

“It’s definitely on the right track, with a positive outlook,” shares another.

While the Your Views survey presents a snapshot of readers’ viewpoints at a particular moment, it should not be considered scientific. Due to rounding, percentages may not add up to 100%.

Subscribers to American Laundry News e-mails are invited to take the industry survey anonymously online each quarter. All managers and administrators of institutional/OPL, cooperative, commercial and industrial laundries are encouraged to participate, as a greater number of responses will help to better define operator opinions and identify industry trends.

Have a question or comment? E-mail our editor Matt Poe at [email protected].