CHICAGO — From time to time, it’s good for industries and businesses to take stock of the state of operations and revenue … and why it is the way it is.

These numbers, trends and details can help guide the way to future success.

In the industrial and institutional laundry industry, many operators indicate that the overall industry and individual businesses are strong and growing.

That’s what the most recent American Laundry News Your Views survey indicates.

When asked to describe, in general, the state of industrial laundry business, 65.2% of respondents indicate it’s “somewhat strong” while 13% say it’s “very strong.”

Only 13% indicate it’s “neither weak nor strong,” and “somewhat weak” and “very weak” were both selected by 4.3% of respondents.

Answers were varied for the reason survey takers chose their answers, such as:

- Sales are up. Telephone calls/inquiries are up.

- Employees returning to the work sites.

- We are seeing an increase in demand for reusable products particularly in Level 2 and OR products. Focus on environmental and sustainability initiatives is driving the increase.

- Industrial laundries are still regarded as an essential service to hospitals and hotels in our markets. There is a demand/push for better service for COG and rental services. That means quality, delivery schedules and fill rates are priorities for hospitals and hotels. If laundries can deliver on all three, that would be the perfect world.

- I manage an on-premises healthcare laundry and track the daily census of the hospital. The census year over year is up around 5% and climbing. We think these are patients who put off basic procedures due to COVID.

- Certain sectors of industrial laundry remain strong regardless of economic factors. Others are currently strong, but the slightest hint of an economic downturn could have a dramatic impact.

- Acquisition and growth among the nationals are keeping prices artificially low, greatly affecting the independents’ ability to keep up with inflation and soaring labor prices

- While revenues are up, mandates and a poor labor climate are preventing net growth.

- Because there is no substantial breakthrough in laundry industry except mechanical automation worldwide.

- Industrial laundry is suffering from a dramatic lack of innovation in their garment products, and this is doubled down by poor service and capability to serve to today’s standards.

- Industry is flatlining with no new markets being developed and few new ideas being trialed.

- Labor and utility costs are still rising while clients are looking for lower pricing.

- We keep signing up business. The pricing is staying relatively flat.

- It’s California.

When comparing business revenue up to mid-2024 compared to the same time last year, 69.6% of respondents indicate they are “somewhat up in revenue.”

Both “it’s the same” and “somewhat down in revenue” were chosen by 13%. Only 4.3% indicate revenue is “way up,” and no one says they are “way down in revenue.”

Reasons for those laundries who say sales have improved include:

- Customer base increased (47.4%).

- Competition decreased (21.1%).

- Costs/expenses decreased (15.8%).

- Offered additional services or extra-profit centers (21.1%).

- Boosted marketing efforts (26.3%).

- Increased prices (52.6%).

- Other (stronger hiring indicated) (10.5%).

For industrial laundries that didn’t see improved sales, reasons ranged from “competition” to “very steady market.”

When asked, “What’s the best thing that’s happened to your business so far in 2024?” Answers include:

- Laundry upgrades of various units to increase profits and reduce operating costs.

- Competition has been making bad decisions on equipment distribution.

- Increased volume.

- Able to hire strong hourly unskilled labor. This particular group of the labor market is strong right now.

- Census growth and improved materials management on core linen items.

- Move to new facility.

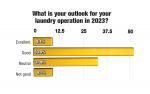

The generally positive atmosphere indicated by survey takers looks to carry on through the rest of the year with 61.9% indicating, “I’m confident my business will keep improving.”

Just over 38% expect their business to remain the same, and no one expresses concern about declines.

Reasons for these attitudes include:

- Stable markets.

- The word is getting out in our new markets about our experience stemming over 85 years in the industrial-commercial laundry industry.

- No new ideas, fresh demand or new opportunities emerging.

- Many companies are concerned about the future economy and will consumer purchases still stay strong.

- We are well-positioned for future growth. Emphasis on reusable products is stronger than ever.

One respondent shares this bit of encouragement, “Hold true on your best practices, maintaining the highest level of service and quality, and deliver on your promises.”

While the Your Views survey presents a snapshot of readers’ viewpoints at a particular moment, it should not be considered scientific. Due to rounding, percentages may not add up to 100%.

Subscribers to American Laundry News e-mails are invited to take the industry survey anonymously online each quarter. All managers and administrators of institutional/OPL, cooperative, commercial and industrial laundries are encouraged to participate, as a greater number of responses will help to better define operator opinions and identify industry trends.

Have a question or comment? E-mail our editor Matt Poe at [email protected].